Extractive Industries, Transparency and Procurement – Increasing Alignment

The movement for greater transparency in extractive industry governance continues to march along at an inspiring pace. Expectation that companies publish how much they pay to governments in host countries is the new normal, and Shell’s recent decision to become the first multinational corporation to disclose country-by-country reporting in line with the OECD template is only the most recent evidence for this.

At the same time, there has also been growing and exciting momentum on increasing the transparency around government procurement. This has been driven by the great work of organizations like Open Government Partnership (OGP) and Open Contracting Partnership.

The OGP and Extractive Industries Transparency Initiative (EITI) recently put together an exciting report outlining synergies between the two initiatives, noting how both initiatives can amplify each other’s efforts. Such a report highlights how much alignment there is between various types of transparencyAccording to OGP’s Articles of Governance, transparency occurs when “government-held information (including on activities and decisions) is open, comprehensive, timely, freely available to the pub... More and governance initiatives, and the potential for collaboration across all of them.

With that in mind, we want to raise the issue of extractive industry procurement by non-state companies and how it fits into the mix at this exciting time.

Transparency in Procurement: Public and Private

If there is growing transparency in payments from extractive industry companies to governments, and also for public procurementTransparency in the procurement process can help combat corruption and waste that plagues a significant portion of public procurement budgets globally. Technical specifications: Commitments that aim t... More by governments, procurement by private sectorGovernments are working to open private sector practices as well — including through beneficial ownership transparency, open contracting, and regulating environmental standards. Technical specificat... More extractive industry companies is a natural next step that links these movements.

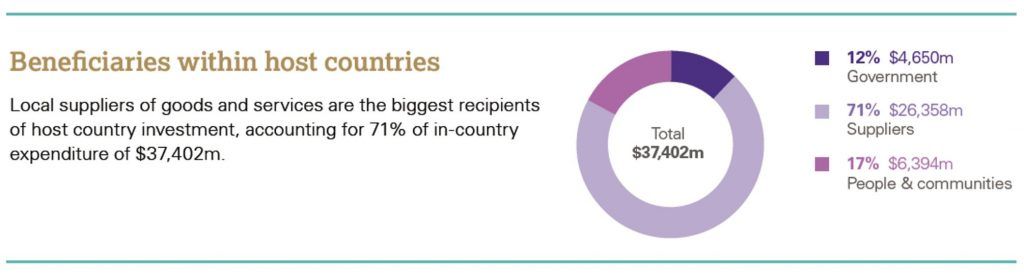

With all the warranted focus on payments to governments by mining and oil and gas companies, it is often lost that in most cases procurement is the single largest in-country payment made by most extractive industry sites.

Breakdown of host country spending by World Gold Council mining company members in 2013

The OGP and EITI already advise that state-owned extractive companies should share information on their procurement processes.

But what about procurement by non-state extractive industry companies?

Ahead of the 44th Board Meeting of the EITI last November in Addis Ababa, the Natural Resource Governance Institute (NRGI)’s Alexandra Gillies wrote a Discussion Paper that explored the potential ways the initiative might combat corruption.

Alexandra states:

“If the EITI was to assume a risk-based approach to prioritising what information should be required to disclose, the oilfield and mining services sector would be at the top of the list. It is a glaring gap in the EITI Standard and the industry constituency.”

We very much welcomed this observation by Gillies but we argue that it also applies to the procurement of goods as well, due to the huge sums of money spent on equipment, fuel, consumables, and other goods.

Gillies is correct that procurement is indeed a gap in the current EITI standard, but many of its member countries are actually already taking steps to look at procurement of mining and oil and gas companies.

As of March 2018, 24 countries were collecting some information on local content in their reporting, though the level of detail at that point was not extensive and in a common format.

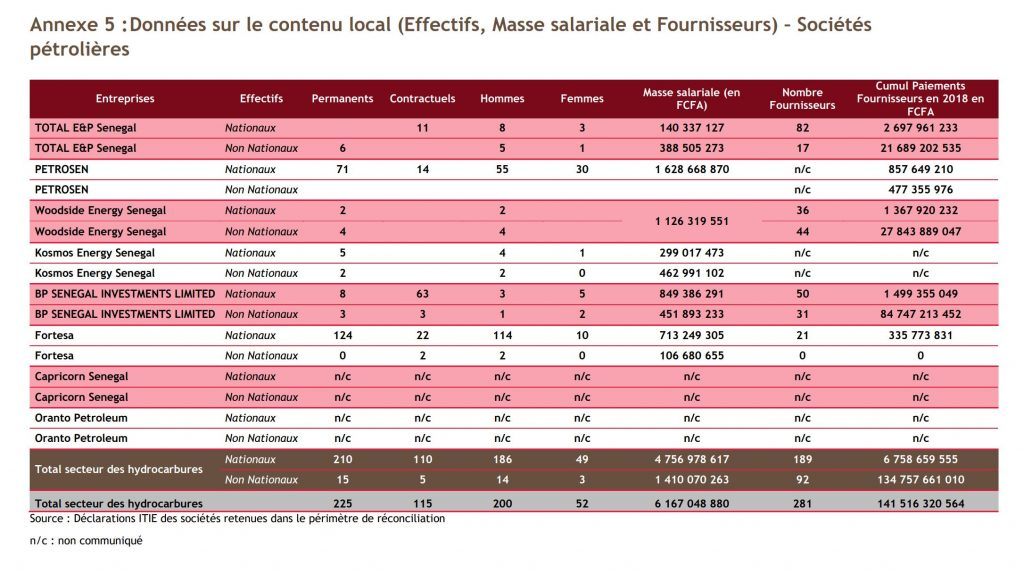

This is changing however as the EITI in Senegal recently launched its Reconciliation report for 2018, and for the first time it included a breakdown of procurement spending by extractive industry companies, showing how much was spent on national suppliers.

EITI Senegal’s Rapport de conciliation 2018 showing procurement spending by extractive industry companies onnational suppliers, both by number of suppliers and by amount spent (p. 189)

As such, extractive industry host countries are starting to see real movement towards increasing transparency for company procurement processes and results in a way that mirrors success in providing more information on public procurement processes.

Next Steps and the Need to Harmonise

For now, our argument is that as much as possible, we need to avoid duplicating and conflicting efforts as these agendas increasingly merge.

- For countries that do decide to collect and disseminate information on mining and oil and gas procurement as part of the EITI process, we should not have each country re-create the wheel and set up conflicting reporting requirements for companies. For example, the Mining Local Procurement Reporting Mechanism (LPRM) is publicly available and offers a template that can be used by state-owned and private sector extractive industry companies alike.

- As much as possible, as transparency initiatives merge towards common goals, efforts should be made to harmonise across existing systems. Initiatives like the Mining LPRM, the Open ContractingA transparent procurement process, known as open contracting, increases competition, improves public service delivery, and ensures governments better value for their money. Technical specifications: C... More Standard, and for that matter the Global Reporting Initiative (GRI) should be in consistent dialogue to ensure information requests to private and public buyers are as harmonised as possible, ideally using the same language.

The sky is the limit to increase transparency and the governance benefits doing so creates. As transparency initiatives increasingly overlap and merge, let’s ensure we do our best to keep everything aligned and harmonised going forward.

Comments (3)

Farai Mutondoro Reply

Highly informative- thank you Jeff. Much a Zimbabwe is not a member of EITI, LPRM might resolve some of the challenges the country is grappling with in the way extractive sector

John Brayman Reply

Excellent article outlining the commonalities and challenges ahead of both the OGP and EITI; organizations and initiatives that Canada is proud to be members of!

Leave a Reply

Related Content

Seeking Synergy: OGP & EITI

This paper explores how OGP and EITI members can leverage both platforms to make meaningful reforms in the extractives industry, one of the sectors most prone to corruption.

Peter Eigen Reply

This is an excellent approach! Congratulations